Wednesday, September 24, 2008

Mark-to-Market Accounting

It seems to me that whatever the accounting bodies do over the debate of valuation accounting, which may take years in deciding and implementing, we are way behind the curve in developing new standards when the real world transactions are evolving so rapidly.

Sunday, September 21, 2008

Rescuing the Financial System: Will it work?

If the system could be easily saved by government pumping in unlimited money into the capital market, it would or should have done it much earlier.

If short selling is really the cause, why banning it only temporarily and limit the ban to financial stocks?

If naked shortselling is unethical and bad, shouldn't 'naked longbuying' be also disallowed? What I mean by 'naked longbuying' is the practice of buying on margins, in which case a market participant purchase something with resources he does not own.

It seems to me that what Ronald Reagan was purported to have said might be relevant in anticipating the consequences of the U.S. Government's proposed action to rescue the market and economy: "The nine most terrifying words in the English language are: ' I'm from the government and I'm here to help.'"

If naked shortselling is unethical and bad, shouldn't 'naked longbuying' be also disallowed? What I mean by 'naked longbuying' is the practice of buying on margins, in which case a market participant purchase something with resources he does not own.

It seems to me that what Ronald Reagan was purported to have said might be relevant in anticipating the consequences of the U.S. Government's proposed action to rescue the market and economy: "The nine most terrifying words in the English language are: ' I'm from the government and I'm here to help.'"

Tuesday, September 16, 2008

"when life hands you lemon..."

In Paul Krugman's 15 September NYT Column, he stated his alternative column title had the U.S. government stepped in and rescue Lehman Brothers:

"When life hands you Lehman, make Lehman aid."

This pun on "When life hands you lemon, make lemonade." is one of the wittiest I have seen in a while.

And in the light of Federal Reserve's willingness since the Bearstern incident in March 2008 to provide liquidity to financial institutions not restricting to Commercial Banks, how much of such aid, I wonder, has been taken up by Lehman Brothers prior to its filing for bankruptcy protection? Would that have meant that the Fed is also one of the creditors awaiting the sorting out of repayment by Lehman in the coming months, if any?

Sunday, September 14, 2008

P/E Ratio: a good gauge?

The P/E ratio of public listed companies around the world (ex-U.S.) has fallen to levels below long-term average. It would seem equities are attractively priced. But before one draws such conclusion, one must re-examine if the basis of comparing the current ratios with the historical ones is still valid.

In recent years, the accounting standards outside of U.S. have undergone major revamp to the extent that the 'E' (i.e. Earning) in the ratio differs materially from the historical ones. And if the denominator of an ratio can not be measured consistently, the temporal ratios cannot be comparable to arrive at relative value.

I would like to highlight two of the significant changes: treatment of goodwill and Mark-to-market accounting:

1. Following introduction IFRS 3 in 2004 goodwill arising from business combination needs no longer be amortised to profit and loss accounts as expenses unless material impairments can be established. As a result, from 2005 onwards, earnings at companies generally received a boost when compared with pre-2004 results;

2. The principle of mark-to-market accounting is simply that of stating asset values at market prices at time of reporting. Previously, the concept was generally observed for current assets but not for non-current assets which were stated at historical costs. The historically cost accounting of non-current assets are gradually replaced by that of mark-to-market. The constant changes in market condition therefore necessitate companies to periodically revaluing more and more of their balance sheet items and reporting the differences as profits or losses. These non-operating-in-nature adjustments render the profit and loss account a less effective gauge of operation results. Case in point: the recent property and equity bubbles has given rise to revaluation in so many companies, especially the property counters, that their 2007 results are breaking all previous records.

Friday, September 12, 2008

Follow-up articles

In his Bloomberg column, Michael Lewis writes about the pitfalls of bailout which echo my sentiment towards the action taken to save Fannie and Freddie.

Two weeks after SEC decided to adopt IFRS, reuters reported on reactions from the regulators of the auditors.

Thursday, September 11, 2008

Currencies and Real Interest Rate

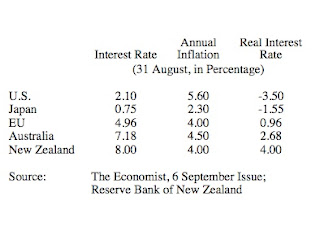

Based on the data as compiled below, it looks like EU, Australia and New Zealand are the three countries that have positive real interest rates while US and Japan are exhibiting negative interest rates:

And although I have not listed down the numbers for other major countries, it can be generally said that positive real interest rates are more of exception than norm. I thus think the outlook for AUD, NZD and, to a lesser extend, Euro are by extension positive.

And although I have not listed down the numbers for other major countries, it can be generally said that positive real interest rates are more of exception than norm. I thus think the outlook for AUD, NZD and, to a lesser extend, Euro are by extension positive.Wednesday, September 10, 2008

SEC to adopt IFRS

As reported on BBC on 28 August 2008

In an effort to align with the international investing community, SEC decides to adopt the International Financial Reporting Standards, without reconciliation. Even more radical, it is proposed that IFRS may replace US GAAP entirely in a few years' time. That is a big step towards connecting with the world for the paradoxically closed country/economy (according to Fareed Zakaria, U.S. is one of the last 3 remaing countries (Liberia and Myanmar are the other two) that has not adopted the metric system).

The reason behind the move has got to be the diminishing market share of New York in the capital market, in the lights of Sarbanes-Oxley Regulations and the emergence/reemergence of Hong Kong, Shanghai and London.

One wonders what is the futures for the professionals (accountants, lawyers etc) who specialise in US GAAP.

The reason behind the move has got to be the diminishing market share of New York in the capital market, in the lights of Sarbanes-Oxley Regulations and the emergence/reemergence of Hong Kong, Shanghai and London.

One wonders what is the futures for the professionals (accountants, lawyers etc) who specialise in US GAAP.

Tuesday, September 9, 2008

Implications of Fannie/Freddie Rescue

The immediate market response was that of relief, and rallies ensued. But what would be the medium and long term implications? I can think of several:

1. Moral Hazard to present and future risk takers;

2. Setting precedent to other struggling companies deemed too large to fail- e.g. motor industry;

3. Increase in money supply and higher long-term interest rates;

4. Delay for the adjustment mechanism to work through both the housing and financial markets.

1. Moral Hazard to present and future risk takers;

2. Setting precedent to other struggling companies deemed too large to fail- e.g. motor industry;

3. Increase in money supply and higher long-term interest rates;

4. Delay for the adjustment mechanism to work through both the housing and financial markets.

Subscribe to:

Posts (Atom)