Wednesday, December 31, 2008

The Politics behind Accounting Standards

The article, titled "Accounting Standards Wild Under Pressure", in Washinton Post details how quickly we, the accountants, change our stance. And we are suppose to issue independent opinions?

Wednesday, December 17, 2008

Origin of Crisis (Part 4)

Act III

As the politicians are busy deregulating the financial sector, the dotcom bubble (touted as historical proportion at the time) was forming throughout the mid-90's (perhaps one can date the beginning with the NASDAQ listingo of Netscape) and reach a fever pitch in Year 2000.

Then it burst. The NASDAQ index plunged from its height of 5,000 level (reached in first quarter of 2000) to below 2,000 points within a year. Events that took place subsequently, though each deserves an Act of its own, happened too quickly that a montage in bullet points might be best employed in laying them out:

1. The trouble at Enron that brought itself to bankrupcy (filed for Chapter 11 in July 2001) and also led to the collapse of its external auditors, Arthur Anderson;

2. Conflict-of-interest scandals within the investment banks and stock-broking houses. Among which are those involving Henry Blodget, an Wall Street analyst who was recommending Hi-tech stocks to clients while privately rubbishing the same stocks, and Frank Quattrone, an investment banker who was allegedly allocating IPO stocks to his clients or prospective clients as favours in exchange for business engagements.

3. The September 11 Attack that depressed the stock markets further and ensured a prolong U.S. recession that began in March 2001, as later confirmed by the National Bureau of Economic Research.

4. The full weight of the events above trigger further corporate collapse and, along with the downfalls, more corporate scandals. The more prominant ones are:

Global Crossing Ltd (filed for Chapter 11 in January 2002);

Worldcom (filed for Chapter 11 in July 2002);

Tyco International (recorded US$9 billion losses in Fiscal Year 2002).

5. The Outbreak of SARS epidemic in November 2002 further depressed economic activity in Asia.

The confluence of events in Act 3 led to a notion that the global financial markets were collapsing and world economy is slipping into a severe recession. Additionally, manufactured goods coming out of China at ever decreasing prices was driving home the point that had there not been any intervention, not only was the world entering a recession, it would be coupled with deflation. It was further argued that deflation, once fully entrench, is even more difficult to get out of using monetary policy.

To slay the beast with dual heads (recession and deflation), US Federal Reserve promptly slashed interest rate at historical pace and kept real interest rate at near zero level for a long period of time. The rate was cut from 6.5% at end of 2000 to 2% by the end of 2001. By July 2003, it was already at (then) historical low of 1%. It was kept at that level for close to one year before the rate was slowly brought up from middle of 2004 to above 2% in beginning of 2005.

Reflecting on historical inflation data of the 3 years between 2002 and 2004 collected monthly, US inflation has fluctuated between 1.07% and 3.73%. Over the same period, Fed Fund Rate was managed within 1.0% and 1.75%. i.e. real interest rate during the 3 years was mostly in the negative region.

Not missing out the opportunities to push for his political agenda and win votes, President Bush launched two major tax-cut packages in 2001 and 2003.

Then it burst. The NASDAQ index plunged from its height of 5,000 level (reached in first quarter of 2000) to below 2,000 points within a year. Events that took place subsequently, though each deserves an Act of its own, happened too quickly that a montage in bullet points might be best employed in laying them out:

1. The trouble at Enron that brought itself to bankrupcy (filed for Chapter 11 in July 2001) and also led to the collapse of its external auditors, Arthur Anderson;

2. Conflict-of-interest scandals within the investment banks and stock-broking houses. Among which are those involving Henry Blodget, an Wall Street analyst who was recommending Hi-tech stocks to clients while privately rubbishing the same stocks, and Frank Quattrone, an investment banker who was allegedly allocating IPO stocks to his clients or prospective clients as favours in exchange for business engagements.

3. The September 11 Attack that depressed the stock markets further and ensured a prolong U.S. recession that began in March 2001, as later confirmed by the National Bureau of Economic Research.

4. The full weight of the events above trigger further corporate collapse and, along with the downfalls, more corporate scandals. The more prominant ones are:

Global Crossing Ltd (filed for Chapter 11 in January 2002);

Worldcom (filed for Chapter 11 in July 2002);

Tyco International (recorded US$9 billion losses in Fiscal Year 2002).

5. The Outbreak of SARS epidemic in November 2002 further depressed economic activity in Asia.

The confluence of events in Act 3 led to a notion that the global financial markets were collapsing and world economy is slipping into a severe recession. Additionally, manufactured goods coming out of China at ever decreasing prices was driving home the point that had there not been any intervention, not only was the world entering a recession, it would be coupled with deflation. It was further argued that deflation, once fully entrench, is even more difficult to get out of using monetary policy.

To slay the beast with dual heads (recession and deflation), US Federal Reserve promptly slashed interest rate at historical pace and kept real interest rate at near zero level for a long period of time. The rate was cut from 6.5% at end of 2000 to 2% by the end of 2001. By July 2003, it was already at (then) historical low of 1%. It was kept at that level for close to one year before the rate was slowly brought up from middle of 2004 to above 2% in beginning of 2005.

Reflecting on historical inflation data of the 3 years between 2002 and 2004 collected monthly, US inflation has fluctuated between 1.07% and 3.73%. Over the same period, Fed Fund Rate was managed within 1.0% and 1.75%. i.e. real interest rate during the 3 years was mostly in the negative region.

Not missing out the opportunities to push for his political agenda and win votes, President Bush launched two major tax-cut packages in 2001 and 2003.

Thursday, December 11, 2008

Mark-to-Market: The debate continues

It seems odd that in the environment of continuing loss of income, employment and wealth in the real economies, discussions on the arcane accounting treatment are still festering. In the past week, I came across two separate news articles that reported views and comments by some of the most senior regulators and executives in the business world on the subject of Mark-to-Market accounting.

SEC head says accounting rules must be neutral (Associated Press; 8 Dec 2008)

Behind Schwarzman Spat With Wasserstein Lies FASB Rule No. 115 (Bloomberg; 8 Dec 2008)

Granted, the issue was not fully resolved by the accounting bodies which, after intense lobbying and protest, allowed certain exemptions from the application of the treatment. But that was two months ago- a long time by 2008 standard (Obama was elected barely a few weeks ago but it seems he has been acting as president for months ). Between the two months, the crisis has spread from wall street to main streets around the world.

And we are still debating how we post a number to a balance sheet that was read by less than a fraction of a percentage of the world population?

SEC head says accounting rules must be neutral (Associated Press; 8 Dec 2008)

Behind Schwarzman Spat With Wasserstein Lies FASB Rule No. 115 (Bloomberg; 8 Dec 2008)

Granted, the issue was not fully resolved by the accounting bodies which, after intense lobbying and protest, allowed certain exemptions from the application of the treatment. But that was two months ago- a long time by 2008 standard (Obama was elected barely a few weeks ago but it seems he has been acting as president for months ). Between the two months, the crisis has spread from wall street to main streets around the world.

And we are still debating how we post a number to a balance sheet that was read by less than a fraction of a percentage of the world population?

Monday, November 24, 2008

“[A]uditors have got to get used to the idea that nothing is as it used to be”

The statement was from Will Rainey, a partner at Ernst & Young UK, as quoted in an article in this week's The Economist.

Monday, November 17, 2008

Liberty, Democracy and Ecomomic Development

In their recent visits to Hong Kong and amidst the financial turmoils, Mr Goh Chok Tong and Mr Chris Patten, expressed their opinions on the relationship between political system and economic development. Their views are vastly different:

(Source: hkej.com)

(Source:hkej.com)

Thursday, November 13, 2008

IHT reported on the South-East Asian economies amidst the global economic slowdown. The article acknowleged that while the contagion that radiates from the West is affecting the region's financial markets and real economies, news of the financial turmoil is greeted "like news of a plague several valleys away."

I will take the analogy further: the patients several valleys away are the major consumers of the regional produces, from commodities, such as paim oil and rubber, to manufactured goods, such as IT products and sports shoes, to the service industries, such as tourism and banking. Who are to support these industries when the patients are being administered heavy dosage of austerity? The situation are especially acute when the plague is spreading across Grand Canyon, Alps and Fuji faster than Ebola virus.

Hopefully, the villagers from Yangtze ang Ganges could acquire the taste of consumerism in double quick fashion, but I won't be holding my breath.

I will take the analogy further: the patients several valleys away are the major consumers of the regional produces, from commodities, such as paim oil and rubber, to manufactured goods, such as IT products and sports shoes, to the service industries, such as tourism and banking. Who are to support these industries when the patients are being administered heavy dosage of austerity? The situation are especially acute when the plague is spreading across Grand Canyon, Alps and Fuji faster than Ebola virus.

Hopefully, the villagers from Yangtze ang Ganges could acquire the taste of consumerism in double quick fashion, but I won't be holding my breath.

Thursday, November 6, 2008

Rediscovering CFOs' Role

The Economist's article on the role of CFOs in this difficult environment.

Saturday, November 1, 2008

Origin of Crisis (Part 3)

Act I

In 1998, Long-Term Capital Management failed. Its failure, well documented in Roger Lowenstein's 2000 book- "When Genius Failed", led to a potentially messy unwinding of trades and put stress to the financial system. True to form as a financial Maestro, Mr Alan Greenspan and his Federal Reserve team coordinated a LTCM bailout plan backed by several major investment banks. Though the plan involved only private capital, it is clear indication that the Fed subscribes to the "too big to fail" notion.

Act II

In 1999, after years of lobbying from the banking industry, the Glass-Steagall Act's provisions that prevented the formation of universal banks was repealed. The specific provison of the Act, enacted by U.S. Congress in 1933 with the intention to arrest the numerous bank-runs during the Great Depression, prohibited commercial banks that take in public deposits from owning and operating non-banking financial institutions such as insurers and investment banks. The idea behind was to ensure commercial banks stay focus in their main line of business and fire-wall them from any non-banking activities and related business risks.

Not long after President Bill Clinton has signed-off the Congress' bill to abolish the provision, consolidation began in the financial sector as universal banks are touted as cost-efficient providers of financial services at greater convenience. Banking groups that encompassed intermediary activities with various other financial services, e.g. insurance, brokerage, investment, are being formed through mergers and acquisitions. Some of these behemouths that exist today are: Citigroup (merger of Citicorp and Travelers Group), JP Morgan Chase (merger of JP Morgan & Co. and Chase Manhattan Corp). In order to compete, other international banking groups, such as UBS and HSBC, traditionally private and commercial banks, are setting up departments to provide investment and other banking services.

In 1998, Long-Term Capital Management failed. Its failure, well documented in Roger Lowenstein's 2000 book- "When Genius Failed", led to a potentially messy unwinding of trades and put stress to the financial system. True to form as a financial Maestro, Mr Alan Greenspan and his Federal Reserve team coordinated a LTCM bailout plan backed by several major investment banks. Though the plan involved only private capital, it is clear indication that the Fed subscribes to the "too big to fail" notion.

Act II

In 1999, after years of lobbying from the banking industry, the Glass-Steagall Act's provisions that prevented the formation of universal banks was repealed. The specific provison of the Act, enacted by U.S. Congress in 1933 with the intention to arrest the numerous bank-runs during the Great Depression, prohibited commercial banks that take in public deposits from owning and operating non-banking financial institutions such as insurers and investment banks. The idea behind was to ensure commercial banks stay focus in their main line of business and fire-wall them from any non-banking activities and related business risks.

Not long after President Bill Clinton has signed-off the Congress' bill to abolish the provision, consolidation began in the financial sector as universal banks are touted as cost-efficient providers of financial services at greater convenience. Banking groups that encompassed intermediary activities with various other financial services, e.g. insurance, brokerage, investment, are being formed through mergers and acquisitions. Some of these behemouths that exist today are: Citigroup (merger of Citicorp and Travelers Group), JP Morgan Chase (merger of JP Morgan & Co. and Chase Manhattan Corp). In order to compete, other international banking groups, such as UBS and HSBC, traditionally private and commercial banks, are setting up departments to provide investment and other banking services.

Thursday, October 23, 2008

Origin of Crisis (Part 2)

In chapter one of 'Freakonomics', the authors explore the incentives behind cheatings in honour sports such as Sumo Wrestling, the national sport of Japan. It derives the conclusion that if the income distribution within specific industries varies greatly between the top and bottom, individual players have great incentive to cheat or cause the system to work in its favour. This is especially true if the industry regulators also have vested interest in tolerating unbecoming behaviours. (for more coverage of the Sumo scandal beyond the book, listen to an audio report by The Economist.)

The chapter provides statistical evidence and present the case convincingly. To solidify their proposition, the authors present in the same chapter some empirical evidence that, under the above mentioned condition, even school teachers cheat in exams- no, not exams they sat as students, but on behalf of students they teach in exams that they invigilate.

If there is a common theme between cheating teachers and sumo wrestlers- indeed if there is a common theme for the book, it is "Incentive".

And that, in my opinion, is the single most important reason behind the financial crisis that we are witnessing. The tsunami begin to gather force many years before and show of all its latent power in the past year. Over the next few postings, I will attempt to document events that I think contributed to the crescendo of financial destruction. I will begin recounting from 1998 (though it might have begun earlier)...

The chapter provides statistical evidence and present the case convincingly. To solidify their proposition, the authors present in the same chapter some empirical evidence that, under the above mentioned condition, even school teachers cheat in exams- no, not exams they sat as students, but on behalf of students they teach in exams that they invigilate.

If there is a common theme between cheating teachers and sumo wrestlers- indeed if there is a common theme for the book, it is "Incentive".

And that, in my opinion, is the single most important reason behind the financial crisis that we are witnessing. The tsunami begin to gather force many years before and show of all its latent power in the past year. Over the next few postings, I will attempt to document events that I think contributed to the crescendo of financial destruction. I will begin recounting from 1998 (though it might have begun earlier)...

Tuesday, October 21, 2008

Origin of Crisis (part 1)

I was listening to BBC radio on Saturday and the presenter was interviewing an economist about the financial crisis. In answering the presenter's question on whether the recent episodes in the financial world has any impact on future economic research works, the economist predicted that there will be a shift away from social topics such as 'Sumo wrestlers' to more macro-economic issues.

Obviously, he was referring to the book, 'Freakonomics', in which there is a chapter on the author's research into the behavioural science of Sumo wrestlers. Indirectly, he implied that these are peripheral studies which may not mean much in steering the future world economic direction.

I cannot disagree with his view more. The ideas behind Freakonomics are extremely relevant to to present economic mess and, dare I even suggest, probably the origin of the crisis.

More later...

I cannot disagree with his view more. The ideas behind Freakonomics are extremely relevant to to present economic mess and, dare I even suggest, probably the origin of the crisis.

More later...

Tuesday, October 14, 2008

Paul Krugman

As a reader who follows Professor Krugman's writings (especially his analysis of the Asian economies before and after the 1990's crisis), I am really pleased about his winning the Nobel Memorial Prize for Economic Science. A sampling of his work- a public lecture that he gave in 2004, may be downloaded at http://forum.wgbh.org

And because of his high public profile (he is a regular columnist at NYT) and his consistent criticism of the Bush Administration and the conservatism in public policies, there are naturally some criticism in the Swedish Academy's decision in giving out the award, especially in the time of financial great unraveling (pun intended). One example is the austrian economists blog.

And because of his high public profile (he is a regular columnist at NYT) and his consistent criticism of the Bush Administration and the conservatism in public policies, there are naturally some criticism in the Swedish Academy's decision in giving out the award, especially in the time of financial great unraveling (pun intended). One example is the austrian economists blog.

Sunday, October 12, 2008

Crisis in Iceland- the hot soup that was boiling for a while

The collapse of the Iceland economy, sudden as it seems to those of us who reside outside of Europe, has been foretold many months ago, as reported by the International Herald Tribune in an article dated 17 April 2008.

For those of us residing in Asia and have witnessed the financial crisis in the 1990's, it is much the same- an economy built on borrowed money and time.

I wonder if Multi-Level-Marketing is recognised as unethical business model for private individuals and enterprises, why is the concept, when applied to international finance, deemed acceptable and legal?

For those of us residing in Asia and have witnessed the financial crisis in the 1990's, it is much the same- an economy built on borrowed money and time.

I wonder if Multi-Level-Marketing is recognised as unethical business model for private individuals and enterprises, why is the concept, when applied to international finance, deemed acceptable and legal?

Thursday, October 9, 2008

Monday, October 6, 2008

Next Change: Mark-to-Market Accounting in EU

It is reported that, after SEC in the U.S. relaxed the Mark-to-Market accounting rules, EU is also looking into changing the application of the valuation method, particularly to the banks and financial institutions that carry on their Balance Sheets substantial amounts of sub-standard assets.

The logic is, I guess, by lifting the requirement for revaluing the carrying amount of such assets which would erode the accounting capitals since the book values are substantially below the assets' market value, the capital adequacy ratio of these institutions would be in much healthier shape.

But should the marketplace be sophisticated enough to differentiate between accounting capital and economic capital?

Besides, mark-to-market has already been practiced form years resulting in many of the assets being carried at previous periods' market prices. So, if mark-to-market were to be suspended and if historical prices were to be adopted, these assets will have to be revised down also. Given the inflated prices go back several years, these assets will have to be written down to historical prices which in effect neutralises the original intension of the suspension.

Or would the authorities then say: " higher of the historical or market value"?

Wednesday, October 1, 2008

Mark-to-Market Accounting- developing story

It seems that the accounting principle of fair-market accounting, a.k.a. mark-to-market accounting, is roundly criticised as the cause of the financial crisis. To the extent, as reported by Financial Times, IAS will have to hold an emergency meeting "to discuss certain topics made controversial by the credit crunch- including "fair value" and off-balance sheet accounting."

Further, it has just been reported the U.S. politicians are exerting pressure on SEC to suspend the accounting practice.

I think in times of desperation and in hope of finding a silver bullet, some of us may reach out and suggest or implement solutions that seemingly tackle the symptoms without necessarily finding the cure.

Accounting, in a nutshell, is just the presentation of the financial status of a company using a specific set of measuring rules. It does not change the underlying qualities of the assets and liabilities of the company. In other words, whether fair-market accounting is adopted or not, the quality of the subprime mortgage assets are unchanged. So, if we assume that the crisis is fundamentally due to the asset qualities at the financial institutions, we should deal with the cleaning out the houses and not just wiping the windows.

Besides, if one were to repeal the use of fair-market accounting, as I have previously written, we should also retroactively restate the previous financial years' financial statements in which excessive profits are recorded by adopting fair-market accounting. In that case, is there any way we can recoup the bonuses paid out to the Management for their 'good performances'?

Wednesday, September 24, 2008

Mark-to-Market Accounting

It seems to me that whatever the accounting bodies do over the debate of valuation accounting, which may take years in deciding and implementing, we are way behind the curve in developing new standards when the real world transactions are evolving so rapidly.

Sunday, September 21, 2008

Rescuing the Financial System: Will it work?

If the system could be easily saved by government pumping in unlimited money into the capital market, it would or should have done it much earlier.

If short selling is really the cause, why banning it only temporarily and limit the ban to financial stocks?

If naked shortselling is unethical and bad, shouldn't 'naked longbuying' be also disallowed? What I mean by 'naked longbuying' is the practice of buying on margins, in which case a market participant purchase something with resources he does not own.

It seems to me that what Ronald Reagan was purported to have said might be relevant in anticipating the consequences of the U.S. Government's proposed action to rescue the market and economy: "The nine most terrifying words in the English language are: ' I'm from the government and I'm here to help.'"

If naked shortselling is unethical and bad, shouldn't 'naked longbuying' be also disallowed? What I mean by 'naked longbuying' is the practice of buying on margins, in which case a market participant purchase something with resources he does not own.

It seems to me that what Ronald Reagan was purported to have said might be relevant in anticipating the consequences of the U.S. Government's proposed action to rescue the market and economy: "The nine most terrifying words in the English language are: ' I'm from the government and I'm here to help.'"

Tuesday, September 16, 2008

"when life hands you lemon..."

In Paul Krugman's 15 September NYT Column, he stated his alternative column title had the U.S. government stepped in and rescue Lehman Brothers:

"When life hands you Lehman, make Lehman aid."

This pun on "When life hands you lemon, make lemonade." is one of the wittiest I have seen in a while.

And in the light of Federal Reserve's willingness since the Bearstern incident in March 2008 to provide liquidity to financial institutions not restricting to Commercial Banks, how much of such aid, I wonder, has been taken up by Lehman Brothers prior to its filing for bankruptcy protection? Would that have meant that the Fed is also one of the creditors awaiting the sorting out of repayment by Lehman in the coming months, if any?

Sunday, September 14, 2008

P/E Ratio: a good gauge?

The P/E ratio of public listed companies around the world (ex-U.S.) has fallen to levels below long-term average. It would seem equities are attractively priced. But before one draws such conclusion, one must re-examine if the basis of comparing the current ratios with the historical ones is still valid.

In recent years, the accounting standards outside of U.S. have undergone major revamp to the extent that the 'E' (i.e. Earning) in the ratio differs materially from the historical ones. And if the denominator of an ratio can not be measured consistently, the temporal ratios cannot be comparable to arrive at relative value.

I would like to highlight two of the significant changes: treatment of goodwill and Mark-to-market accounting:

1. Following introduction IFRS 3 in 2004 goodwill arising from business combination needs no longer be amortised to profit and loss accounts as expenses unless material impairments can be established. As a result, from 2005 onwards, earnings at companies generally received a boost when compared with pre-2004 results;

2. The principle of mark-to-market accounting is simply that of stating asset values at market prices at time of reporting. Previously, the concept was generally observed for current assets but not for non-current assets which were stated at historical costs. The historically cost accounting of non-current assets are gradually replaced by that of mark-to-market. The constant changes in market condition therefore necessitate companies to periodically revaluing more and more of their balance sheet items and reporting the differences as profits or losses. These non-operating-in-nature adjustments render the profit and loss account a less effective gauge of operation results. Case in point: the recent property and equity bubbles has given rise to revaluation in so many companies, especially the property counters, that their 2007 results are breaking all previous records.

Friday, September 12, 2008

Follow-up articles

In his Bloomberg column, Michael Lewis writes about the pitfalls of bailout which echo my sentiment towards the action taken to save Fannie and Freddie.

Two weeks after SEC decided to adopt IFRS, reuters reported on reactions from the regulators of the auditors.

Thursday, September 11, 2008

Currencies and Real Interest Rate

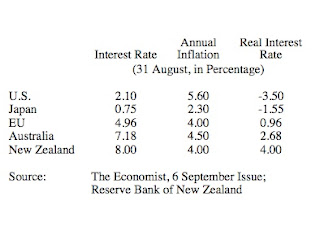

Based on the data as compiled below, it looks like EU, Australia and New Zealand are the three countries that have positive real interest rates while US and Japan are exhibiting negative interest rates:

And although I have not listed down the numbers for other major countries, it can be generally said that positive real interest rates are more of exception than norm. I thus think the outlook for AUD, NZD and, to a lesser extend, Euro are by extension positive.

And although I have not listed down the numbers for other major countries, it can be generally said that positive real interest rates are more of exception than norm. I thus think the outlook for AUD, NZD and, to a lesser extend, Euro are by extension positive.Wednesday, September 10, 2008

SEC to adopt IFRS

As reported on BBC on 28 August 2008

In an effort to align with the international investing community, SEC decides to adopt the International Financial Reporting Standards, without reconciliation. Even more radical, it is proposed that IFRS may replace US GAAP entirely in a few years' time. That is a big step towards connecting with the world for the paradoxically closed country/economy (according to Fareed Zakaria, U.S. is one of the last 3 remaing countries (Liberia and Myanmar are the other two) that has not adopted the metric system).

The reason behind the move has got to be the diminishing market share of New York in the capital market, in the lights of Sarbanes-Oxley Regulations and the emergence/reemergence of Hong Kong, Shanghai and London.

One wonders what is the futures for the professionals (accountants, lawyers etc) who specialise in US GAAP.

The reason behind the move has got to be the diminishing market share of New York in the capital market, in the lights of Sarbanes-Oxley Regulations and the emergence/reemergence of Hong Kong, Shanghai and London.

One wonders what is the futures for the professionals (accountants, lawyers etc) who specialise in US GAAP.

Tuesday, September 9, 2008

Implications of Fannie/Freddie Rescue

The immediate market response was that of relief, and rallies ensued. But what would be the medium and long term implications? I can think of several:

1. Moral Hazard to present and future risk takers;

2. Setting precedent to other struggling companies deemed too large to fail- e.g. motor industry;

3. Increase in money supply and higher long-term interest rates;

4. Delay for the adjustment mechanism to work through both the housing and financial markets.

1. Moral Hazard to present and future risk takers;

2. Setting precedent to other struggling companies deemed too large to fail- e.g. motor industry;

3. Increase in money supply and higher long-term interest rates;

4. Delay for the adjustment mechanism to work through both the housing and financial markets.

Subscribe to:

Posts (Atom)